伦敦金购买的指标是什么英文

来源于:本站

发布日期:2025-09-21 10:10:17

The Indicators for Buying Gold in London: Your Ultimate Guide

As the world of finance continues to evolve, gold remains a timeless investment. Particularly, London gold is considered a benchmark for gold trading worldwide. Whether you're a seasoned investor or a curious beginner, understanding the indicators for buying gold in London can significantly enhance your investment strategy. In this post, we'll explore key factors to consider when purchasing gold and how to navigate this glittering market effectively.

1. Market Trends and Economic Indicators

Before you dive into buying gold, it's crucial to analyze market trends. Gold prices are influenced by various economic indicators, including inflation rates, interest rates, and geopolitical stability. When inflation rises, gold often becomes a safer investment, leading to increased demand and higher prices. Conversely, when interest rates are high, the opportunity cost of holding gold increases, which may lead to a decrease in gold prices.

Tip: Keep an eye on economic news and financial reports. Tools like economic calendars can help you track significant events that may impact gold prices.

2. Gold Spot Price

The gold spot price is the current market price for immediate delivery of gold. This price fluctuates constantly based on supply and demand factors. In London, the London Bullion Market Association (LBMA) plays a significant role in setting the daily gold spot price, which is referenced globally.

To make informed purchasing decisions, monitor the spot price regularly. Websites and apps dedicated to precious metals can provide real-time updates on gold prices.

Tip: Consider setting price alerts to notify you when gold reaches a price point that fits your investment strategy.

3. Technical Analysis

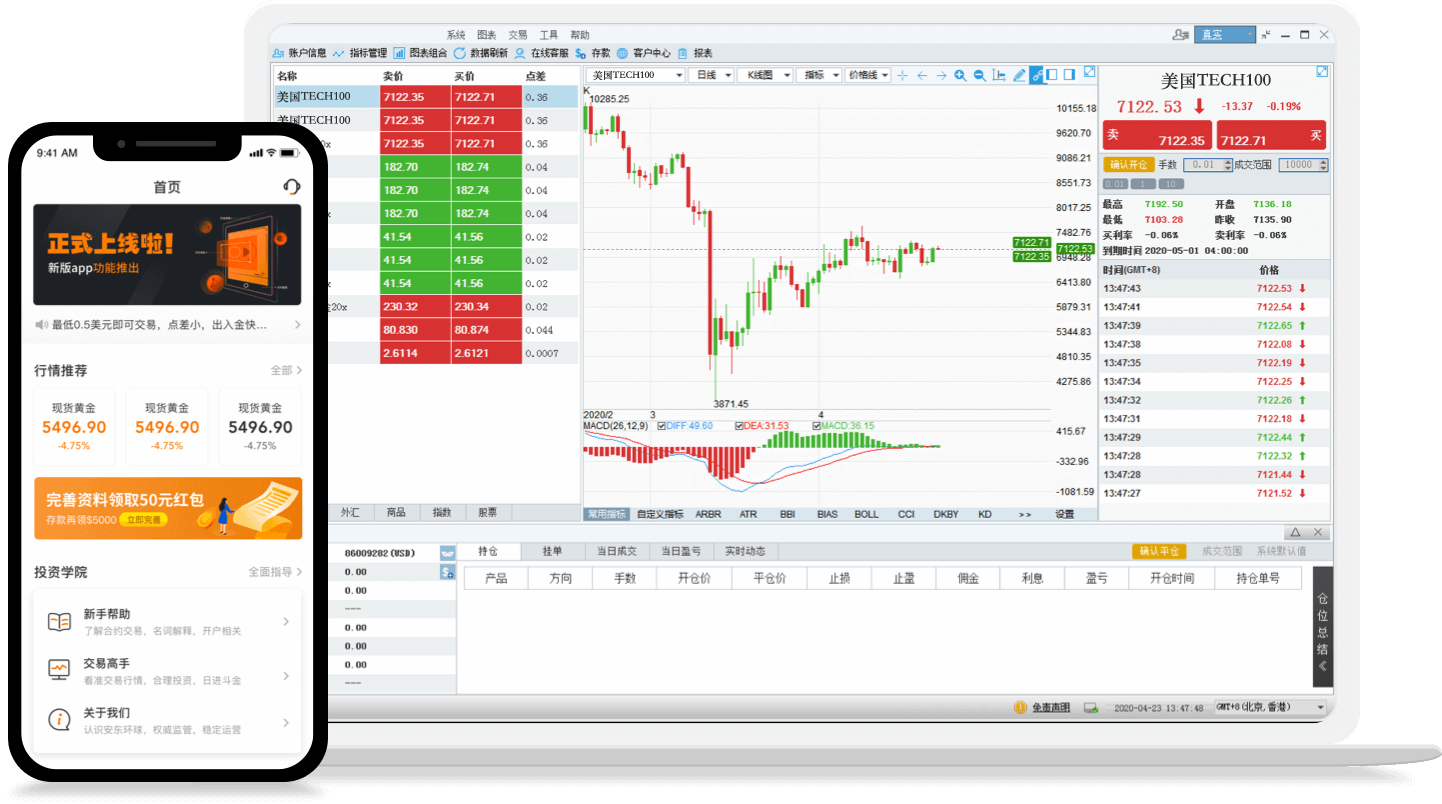

Many traders rely on technical analysis to make short-term trading decisions. This involves studying price charts and identifying patterns that may indicate future price movements. Key indicators to look out for include moving averages, Relative Strength Index (RSI), and support and resistance levels.

Tip: If you’re new to technical analysis, consider using trading platforms that offer educational resources and tutorials. This knowledge can empower you to make more informed decisions.

4. Seasonal Trends

Interestingly, gold prices can exhibit seasonal trends. Historical data shows that gold prices tend to rise during certain times of the year, particularly around major festivals or holidays when demand for jewelry increases, such as Diwali in India or Christmas in the West.

Tip: Research historical price trends during specific seasons to identify potential buying opportunities.

5. Geopolitical Events

Gold is often seen as a safe-haven asset. During times of geopolitical uncertainty, such as wars, elections, or economic crises, investors flock to gold, driving up its price. Keeping an eye on global events can help you anticipate market movements and make timely purchases.

Tip: Follow reputable news sources and financial analysts to stay updated on geopolitical developments that may affect the gold market.

6. Physical vs. Paper Gold

Decide whether you want to invest in physical gold (like coins or bars) or paper gold (like ETFs and derivatives). Physical gold requires storage and insurance, while paper gold can be more liquid and easier to manage. Each has its pros and cons, so consider your investment goals.

Tip: If you choose physical gold, ensure you purchase from reputable dealers and consider the costs of storage and security.

7. Long-Term vs. Short-Term Investment

Your investment strategy should align with your financial goals. If you’re looking for a long-term hedge against inflation, buying physical gold might be the way to go. However, if you’re interested in short-term gains, consider trading paper gold or ETFs based on market fluctuations.

Tip: Establish a clear investment plan and stick to it. This will help you avoid emotional decision-making during market volatility.

Conclusion

Investing in gold, particularly in the bustling market of London, can be a rewarding venture if approached with the right knowledge and strategy. By understanding key indicators such as market trends, gold spot prices, technical analysis, and geopolitical events, you can make more informed decisions. Remember to stay updated, be patient, and invest wisely. Happy investing!

---

This guide aims to equip you with essential insights into buying gold in London, helping you navigate this exciting market with confidence. If you found this information valuable, don't forget to share it with fellow gold enthusiasts!

温馨提示:本站所有文章来源于网络整理,目的在于知识了解,文章内容与本网站立场无关,不对您构成任何投资操作,风险 自担。本站不保证该信息(包括但不限于文字、数据、图表)全部或者部分内容的准确性、真实性、完整性、原创性。相关信 息并未经过本网站证实。

文章标签: 无

分享到

客户对我们的评价

伦敦金投资来自海南三亚的网友分享评论:

伦敦金投资是一个充满机遇的领域,吸引了越来越多的投资者参与。作为一种全球认可的贵金属投资方式,伦敦金不仅具有保值增值的优势,还能有效对冲通货膨胀。在市场波动中,灵活的交易方式和高杠杆效应使得投资者能够在短时间内实现收益。然而,投资风险不可忽视,了解市场动态和掌握基本分析技巧是成功的关键。建议新手投资者从小额入手,稳步积累经验。

伦敦金投资来自宁夏固原的网友分享评论:

伦敦金投资是一种灵活且具有潜力的理财方式。作为一种国际认可的贵金属,黄金在经济波动和通货膨胀时常被视为避险资产。投资者可以通过小额资金参与,获取市场波动带来的机会。当然,投资需谨慎,了解市场动态和风险管理是成功的关键。对于新手来说,掌握基本知识、制定合理策略,将有助于在这个领域稳步前行。总之,伦敦金投资既是财富增值的途径,也是对经济形势的深刻洞察。

伦敦金投资来自吉林四平的网友分享评论:

伦敦金投资近年来备受关注,作为一种灵活的投资方式,它不仅能对抗通货膨胀,还能为投资者提供不错的收益潜力。不过,投资者需谨慎对待,理解市场波动及相关风险。通过专业分析和合理配置资产,可以更好地把握机会。同时,保持良好的心态和耐心,才能在这个竞争激烈的市场中立于不败之地。总之,伦敦金是一条值得探索的投资道路,但成功的关键在于知识和策略的结合。

伦敦金知识

国际伦敦金投资基础知识讲解

- 伦敦金知识 以伦敦金交易的多换是什么意思? 2025-09-26

- 伦敦金知识 以伦敦金用通达信软件是什么代码? 2025-09-25

- 伦敦金知识 伦敦金做多与做空的符号是什么 2025-09-24

- 伦敦金知识 伦敦金交易限价挂单是什么意思 2025-09-24

- 伦敦金知识 伦敦金中的合约单位是什么意思 2025-09-23

- 伦敦金知识 伦敦金的外盘和内盘是什么意思 2025-09-23

- 伦敦金知识 伦敦金上涨与下跌的原因是什么 2025-09-22

- 伦敦金知识 期货市场的伦敦金名字是什么 2025-09-22

- 伦敦金知识 伦敦金看多看空的理由是什么 2025-09-21

- 伦敦金知识 伦敦金购买的指标是什么英文 2025-09-21

- 伦敦金知识 伦敦金强制平仓点是什么意思 2025-09-20

- 伦敦金知识 伦敦金操作中锁仓是什么意思 2025-09-19